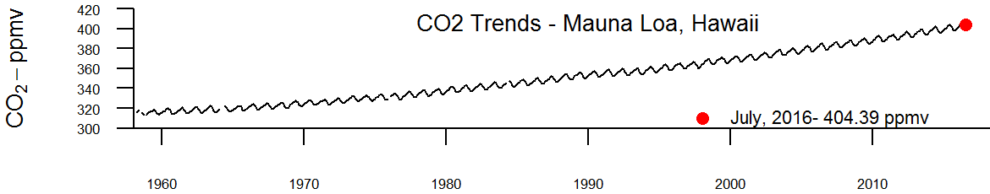

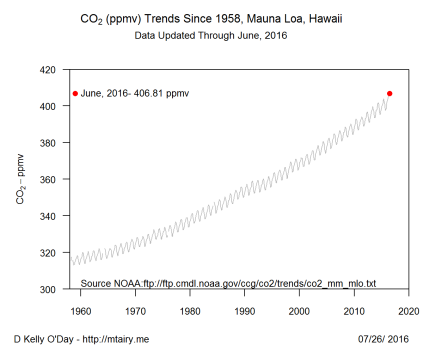

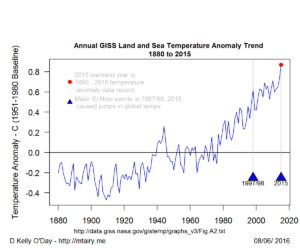

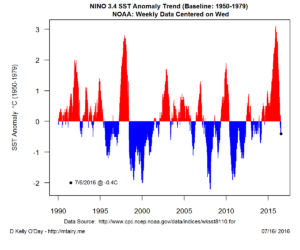

This blog focuses on how to use R to study climate data. I will be using readily available public climate data and R to understand global warming and climate trends. These charts show the types of that I will be making.

RClimate

Using R and Data Visualization To Understand Climate Change